The WeWork House of Cards

Why Business Fundamentals Matter More Than Ever

I almost worked at WeWork as a Finance Director in 2019.

I remember taking the Eurostar from Paris to London and going through the little publicly available information I had.

I went through the valuation once, twice, thrice. I couldn't get my head around it.

To me, it sounded just like another real estate company providing office space.

But the money was good. So, I ignored my spidey sense and decided to give it a shot.

I arrived at the offices and was amazed at the amount of glamour around the office.

Free drinks. Free food. Game room. Friendly staff. Almost like a night out in the town.

I loved it. But, in the back of my mind, I was still wondering what they did and why there was so much hype about the company.

I managed to clear every single interview round, but …

They went with someone else.

Looking back, this was definitely a blessing in disguise.

Why? Let me show you.

WeWork or WeDream?

First, let’s answer an important question: How did WeWork actually work?

Their business model was predicated on the idea of taking long-term leases on commercial properties, refurbishing them into modern co-working spaces, and then subleasing them on shorter-term contracts.

A lot of their members were startups and freelancers. But some of their tenants were big companies such as Facebook and Microsoft.

The appeal was clear: flexible working spaces with modern amenities that businesses could use. And without committing to a traditional lease. Great idea, right?

The gig economy and remote work came at the perfect time. And just like adding wood to the fire, business started booming.

OK, so now we get how they made money. But, now …

Let’s answer another important question: What’s wrong with this picture?

If you think about it, what WeWork was fundamentally doing was “rent arbitrage”.

In concrete words, you lease a building for 15 years at one rate and sublease the space to members on a monthly basis, for example.

The logic here is that the revenue coming from the volume of short-term memberships (at a certain price point) will surpass the long-term lease payment for the same period.

However, this is very risky because it creates a duration mismatch.

In other words, if the economy goes south and people abandon their spaces on short notice (remember, they’re paying a monthly fee with cancellation rights), WeWork will see a decline in revenue, while still being liable for the long-term lease obligation.

That would create a lot of pressure on cash flow and profit.

And it did.

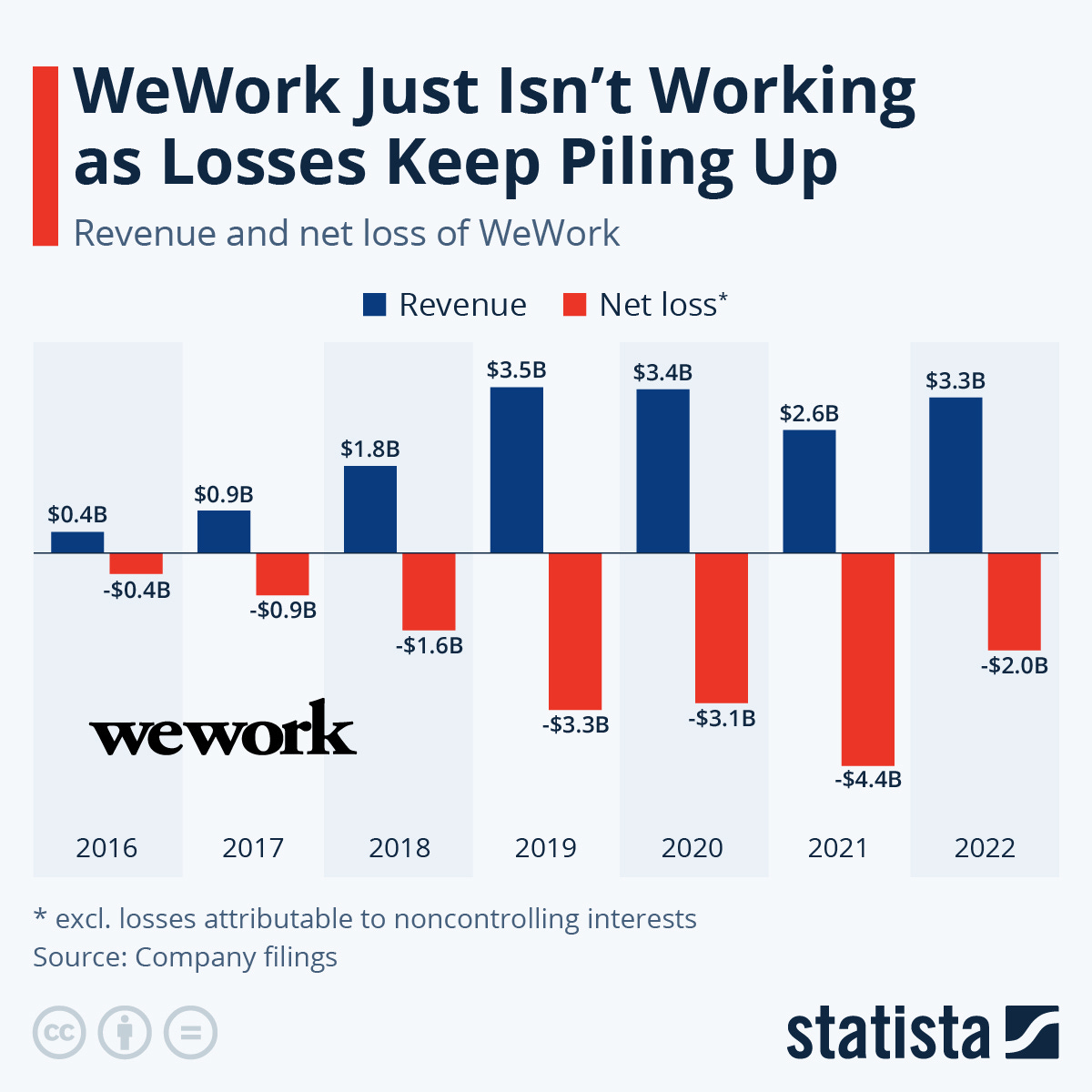

The company was burning cash and losing money at the same rate as revenue was going up.

Not a good story. Not even a good dream.

At this point, you should have noticed two things:

The idea might sound great, but the business fundamentals sound risky.

But most importantly …

I never referred to WeWork as a Tech company.

Huh? Yep. WeWork was considered a tech unicorn.

Not just by the CEO and the staff. But also by some of the biggest investors in the world.

Namely, SoftBank.

A $47 Billion Lie

At its peak, WeWork was valued at $47 billion.

To put that number in perspective, companies in the same industry like CBRE or IWG were not even 10% of that.

So, why would these guys be treated differently? Well …

The answer is simple: WeWork believed they were a tech company. And Adam Neumann would harp on this every single time he got a chance to.

In fact, the word “technology” appears 93 times in the prospectus they filed with the SEC at the time they were going public. I sh*t you not. Do a Ctrl+F on the S-1 and see for yourself.

The valuation was primarily based on growth metrics and the “potential” for future profitability, rather than present-day financial health. Their favorite metric was the infamous “community-adjusted EBITDA”.

Tech companies often receive higher valuations because scaling software doesn’t require a huge cost burden. But WeWork was capital-intensive.

Think of all the property and equipment in every building they leased, and the community managers and staff overseeing new member acquisition and overall satisfaction.

That’s a huge corporate cost that regular tech companies don’t have.

This was an odd case of extreme optimism on market domination.

But many people pushed Adam Neumann’s narrative. Included in those people was SoftBank’s CEO, Masayoshi Son, who injected billions of dollars in investments that managed to push the valuation to $47 billion.

Soon enough, SoftBank would realize this was a BIG mistake.

The House Is On Fire

Like they say, all good things must come to an end.

And WeWork was no exception.

After going public, the company went south in many ways.

A cut in its valuation from $47 billion to $5 billion, the ousting of Adam Neumann as CEO, and 2,400 layoffs across the company.

Business challenges of every type came knocking on WeWork’s door.

Mismatched lease structures: Co-working spaces saw a drop in demand due to recession fears and the latest rounds of layoffs happening across the tech industry. That fear in the fundamental business model of the company came to pass.

Overexpansion: WeWork was known for growing its tentacles fast in the real estate industry. Every week, it felt like they had a new office in one of the most coveted districts of countries like Singapore, the UK, and Australia. The problem with that was that global expansion without establishing profitability in those markets is a recipe for failure. Besides the long-term lease commitment, the retrofitting of each building would accrue massive liabilities that would come and hunt them down the line.

Corporate governance: Adam Neumann was not just the owner of the company but he was also a tenant. He was, allegedly, also a customer. This gave the perception of a huge conflict of interest. Part of the reason why the board asked Neumann to step down.

The issues kept piling up on after the other. To the point that, as of this week, executives have sounded the alarm on whether the company can exist at all. This is known as the “going concern” principle. Accounting 101.

And now, the stock is practically worthless.

Here’s an excerpt of WeWork’s Q2 2023 earnings release.

“In a difficult operating environment, we have delivered solid year-over-year revenue growth and dramatic profitability improvements,” David Tolley, Interim Chief Executive Officer, commented. “Excess supply in commercial real estate, increasing competition in flexible space and macroeconomic volatility drove higher member churn and softer demand than we anticipated, resulting in a slight decline in memberships.

In addition, as disclosed in WeWork’s Quarterly Report for the three and six months ended June 30, 2023 (the “Second Quarter 10-Q”), as a result of the Company’s losses and projected cash needs, combined with increased member churn and current liquidity levels, substantial doubt exists about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is contingent upon successful execution of management’s plan to improve liquidity and profitability over the next 12 months.”

The Importance of Accounting Fundamentals

Reporting the inability for the company to continue is a big deal.

It means liquidating assets, restructuring the business, and firing people. Basically, shutting down the whole thing.

It speaks volumes about the need for financial literacy in business. Especially in an era when is easier than ever to get a check from investors to scale a business.

It says a lot about how investors and founders can get fixated on growth metrics and stories that will, supposedly, disrupt and revolutionize industries, rather than basic profitability and market fit.

At some point, income statements, balance sheets, and cash flow statements have to be the signals we take into consideration to running the ship. I wrote a quick masterclass on Twitter that seemed to work. You can check it out in the link below.

https://twitter.com/theantonioreza/status/1688531699771326465?s=61&t=9Fywxctpd7eylzM5v4zU_g

I don’t doubt there was talent in the finance team.

But, this feels like there was a king at the top. And anybody who would disagree with the “flow” at WeWork would get tossed to the guillotine.

Therefore, I can only assume the WeGeneration was more of a dictatorship than a community.

I hope you liked this week’s issue. If you like the newsletter, please forward it to a friend!

For now, I wish you a fantastic weekend from the Loire Valley in France.

Until next time!

Antonio.

Great article Antonio !