The Rise Of Corporate Empires

Why Companies Become More Powerful Than Nations

Can a company be more powerful than a country?

Maybe …

Think about Apple. What’s the first thing that comes to your mind? iPhones. Macbooks. But it’s so much more than that.

Behind those beautifully designed products, there’s a behemoth that exerts influence in everything that you do every day. And it probably knows you better than you know yourself.

It has access to your biometrics, from your fingerprints (via TouchID) to your face (via FaceID).

It knows your purchasing tendencies every time you buy something (thanks to every Apple Pay).

It can locate you and calculate how many steps you take in any direction (via Health).

It even knows if your heart is malfunctioning.

Apple has managed to wrap itself in the fabric of society.

Hardware. Software. Financial Services. Healthcare. AI. VR. And many more.

With 2 billion iOS users around the world, it is only logical to think the level of influence this company has goes beyond what many countries can do.

How does a company obtain that kind of power? Let’s explore that.

This shift in power dynamics can be attributed to various factors, such as the ability of companies to generate vast financial resources, their global reach, and the increased influence they wield on politics and society.

The Financial Might Of Corporations

To understand this phenomenon, consider the valuation of tech companies.

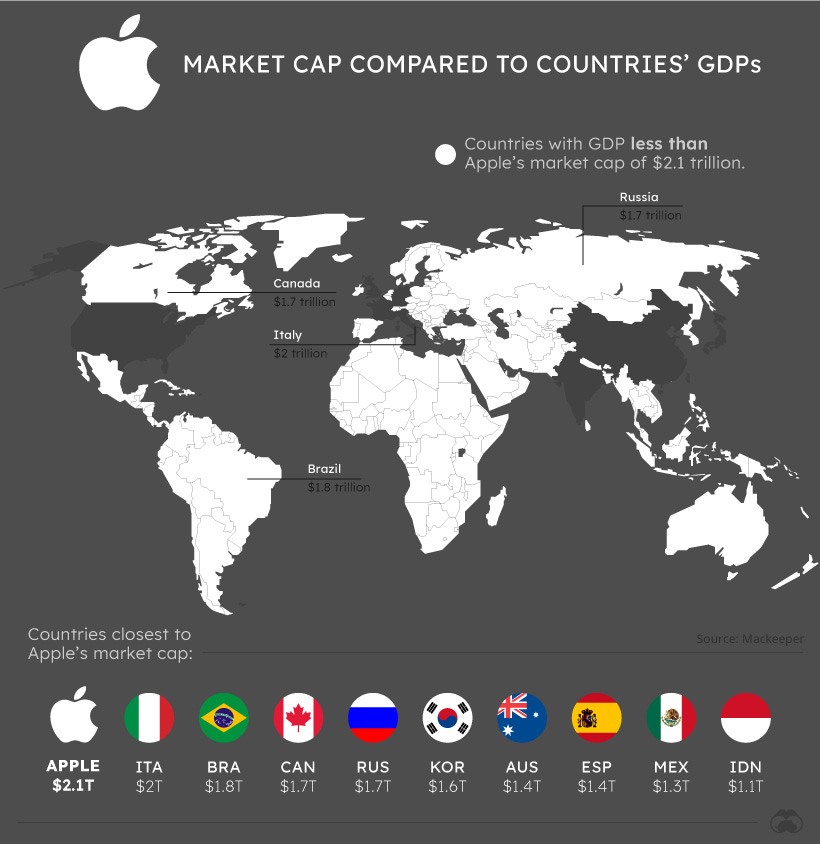

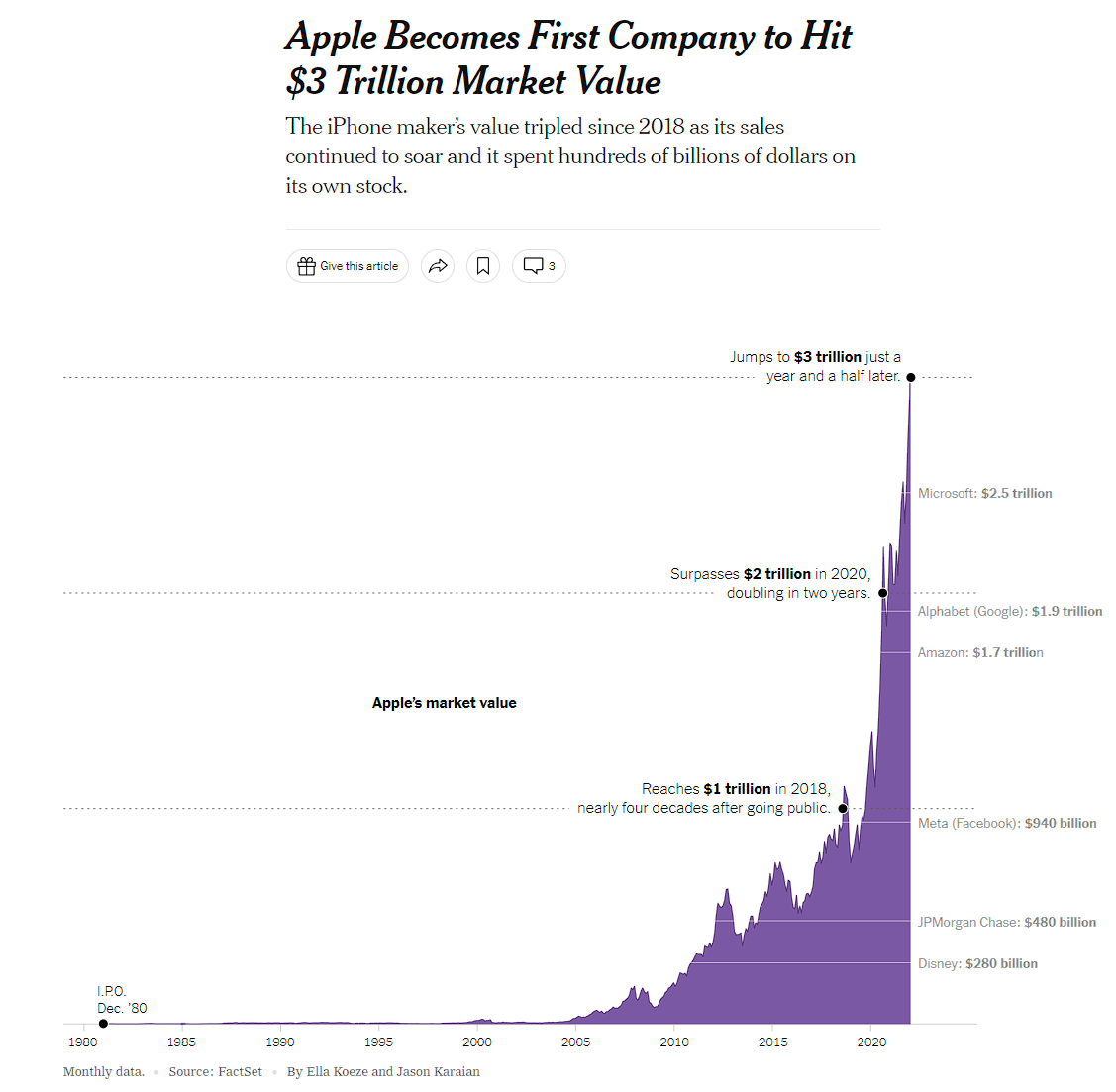

Apple, was the first company to reach a market capitalization of $3 trillion. This figure is just as large as the Gross Domestic Product (GDP) of countries like France and the UK, which are among the top 10 largest economies in the world.

Even though these are two different metrics that measure different things and should not be used for comparison purposes, it gives you an idea of how much value investors are placing in the company.

From an economic perspective, these corporations have a level of financial power that can directly influence global markets, shape industry standards, and even impact national economies.

When companies of this magnitude make strategic moves, such as shifting manufacturing bases or altering supply chains, it can lead to significant economic changes in the countries involved.

For example, Apple has been trying to move its manufacturing away from China, which would affect many jobs.

On the other hand, India and Taiwan, the two countries where manufacturing operations would move into, would benefit greatly.

The Invisible Hand

Another point worth considering is the global reach of these corporations.

Unlike countries, corporations are not geographically bound. They can operate across borders, navigate through different laws and regulations, and reach out to consumers worldwide.

This international presence gives corporations a form of influence and soft power that many countries cannot match.

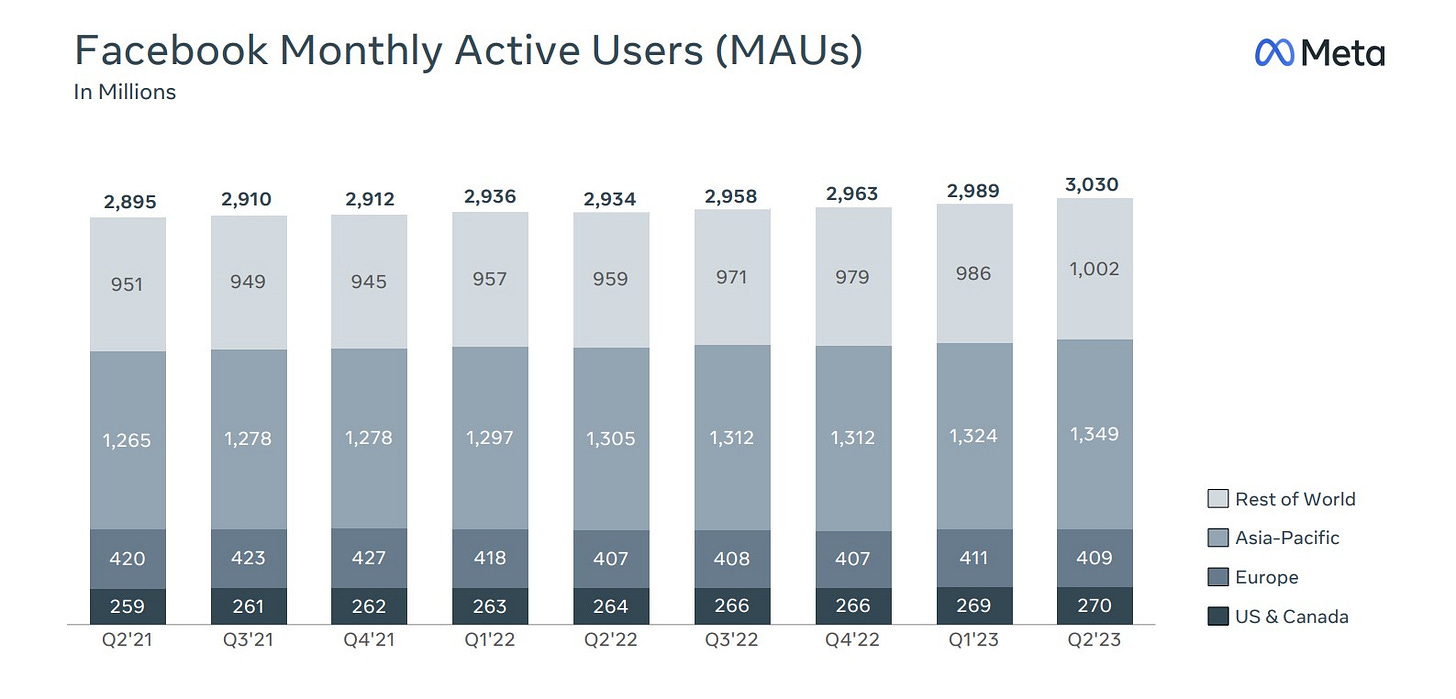

For instance, consider the social media giant Facebook (now Meta).

With a user base of over 3 billion people as of 2Q’23, the platform reaches far more individuals than any single country. The influence of such platforms on public opinion, information dissemination, and even political discourse, is a testament to their power.

Not too long ago, we were talking about Russian meddling in US elections and the invisible hand on the Brexit vote. Remember Cambridge Analytica? If you don’t, do yourself a favor and watch the Social Dilemma.

Furthermore, corporations are increasingly influential in political matters. Through lobbying, corporations can shape policies and regulations to favor their interests.

This trend is evident in the United States, where, according to newly filed lobbying disclosures, over $55 million was spent on lobbying in 2021 by Apple, Amazon, Facebook, and Google.

That’s an army of lawyers trying to push an agenda with legislators and other government officials.

Too Big To Fail?

This influence isn't limited to policy. It can extend to economic stability. The economic fallout of corporations can have far-reaching consequences on countries economies.

For example, the bankruptcy of Lehman Brothers in 2008 was a critical catalyst of the global financial crisis, leading to recessions in several countries.

Due to the interconnectedness of financial institutions, banks worldwide faced the prospect of significant losses. This led to a lack of trust between banks and a freezing of interbank lending, which is a key mechanism for maintaining liquidity in the global financial system.

The gross domestic product (GDP) of certain countries contracted because of this: 2.5% in the United States, and 4.5% in the Eurozone. This impacted people’s livelihoods in a way we hadn’t seen in a long time.

However, while corporations have amassed significant power, they exist within the legal and regulatory frameworks provided by countries. And also, the power of countries extends beyond the economic dimension, with military, diplomatic, and cultural elements that corporations do not possess.

Nonetheless, all of that doesn’t diminish the amount of influence these corporations exert in society.

Just look at the amount of layoffs these companies have made in the past 12 months. I wrote a an article called “Why Layoffs Are Far From Over last week. Feel free to check it out to understand the details.

Without a doubt, tech companies and banks are become too big to fail. And they’re succeeding, without you even noticing.

Will this trend continue? It’s possible.

Regulators are trying to split them up or ring fence them into what they can and cannot do. But it’s only the beginning.

There’s no doubt in my mind, this will keep happening, especially as we enter the new era of AI.

Hope you enjoyed reading this. If you think someone else will enjoy this type of content, please forward them so they can subscribe too!

See you next week!

Antonio.