The Dichotomy of Jack Welch’s Legacy

Manager of the Century or Fraud of the Century?

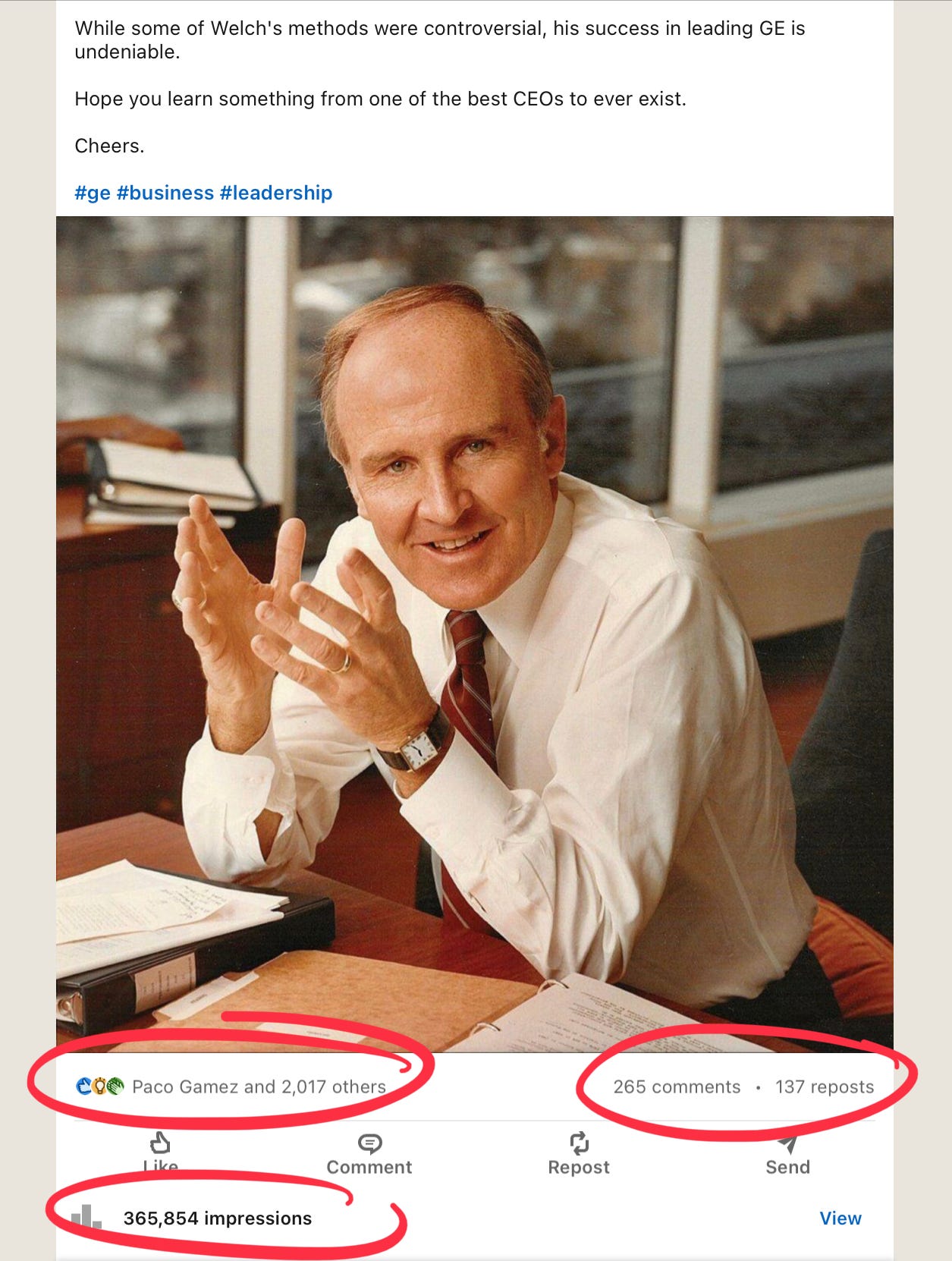

Last week, I wrote a post on Linkedin about Jack Welch and the management lessons he imparted during the two decades he ran GE.

The post was … somewhat controversial. More than 365K impressions and 2K reactions. Crazy.

Why? What struck a chord with so many people?

Brief Intro - Neutron Jack

For those of you who don’t know who this person is, Jack Welch (aka Neutron Jack) was named “Manager of the Century” by Forbes Magazine in 1999.

During his tenure, GE created a 5,200% return for its investors (2x the S&P 500). Its market cap went through the roof and become one of the most valuable companies to ever exist. A true American icon.

So why is he such a polarizing character? Shouldn’t people love a guy who delivered on the most fundamental business promise — increasing shareholders value?

Let’s break down the two sides based on the comments this post got.

The Lovers

The people who love Jack, love him unconditionally.

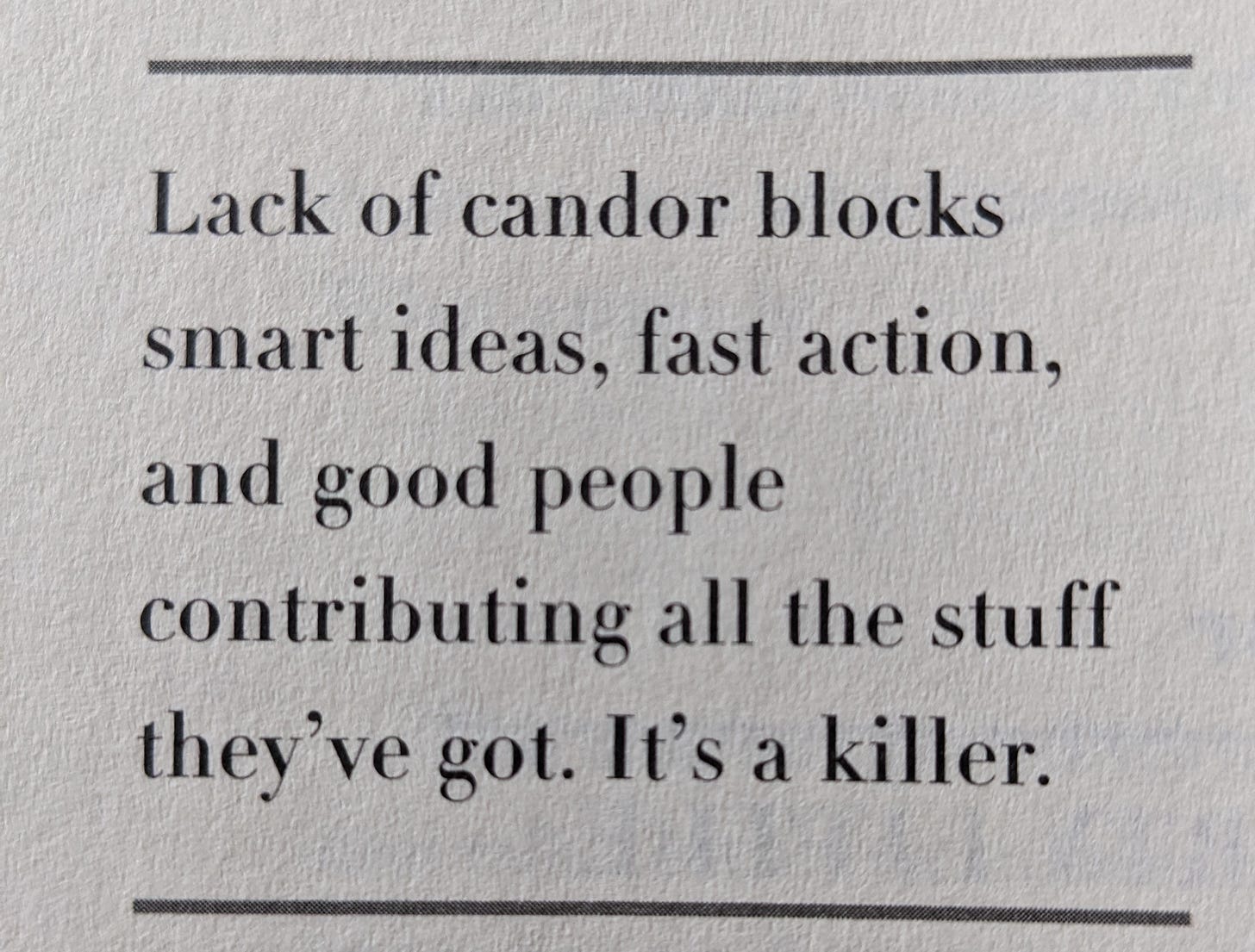

Many people commented on how much they loved the ruthless candor he demanded in the organization, his obsessiveness with Six Sigma to drive productivity, and his commitment to develop people in tough assignments.

These traits permeated the organization more than a decade after he was gone during the Jeff Immelt era.

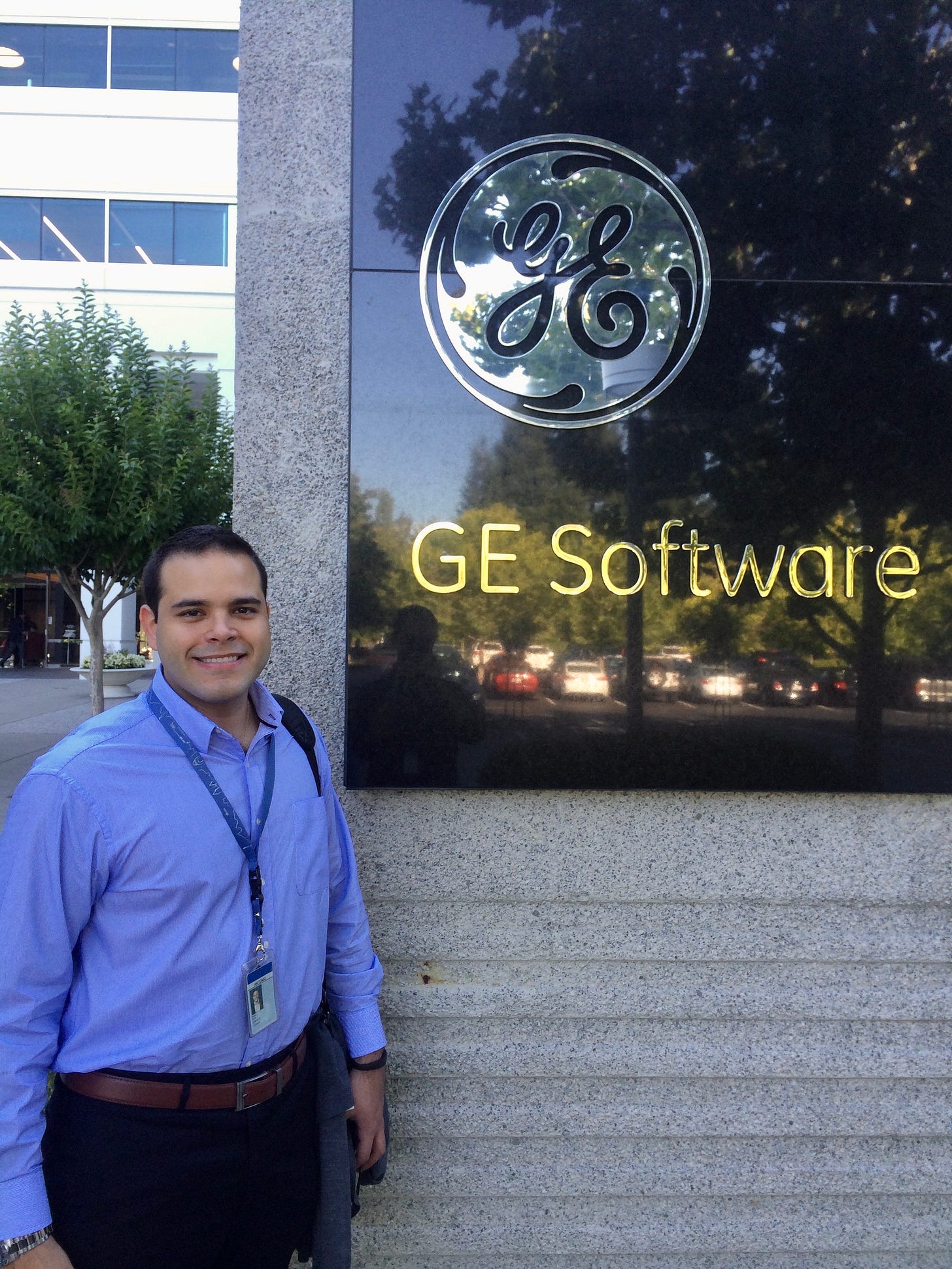

How do I know? I was there during that time.

When I was a young auditor looking for trouble, my peers and I were expected to be brutally honest with the CFOs of GE businesses. This applied to any issue we could find. Accounting discrepancies. Compliance violations. Anything that would put the company in harm’s way. We didn’t hold back any punches.

That wasn’t easy, though. And it wasn’t for the faint of heart. Two times out of three, executives would yell at us frustrated, and challenge every observation we would have. And they would use words and phrases intended to make you cry in the bathroom wondering why the hell would you have signed up for this type of job.

“Get your sh*t together!” was probably one of the ones I heard the most.

However, that was the point. It was tough love. I developed a thick skin because of that. I didn’t always like it, but deep down, most of those executives were developing the next generation of leaders.

To me, that was candor. At its purest form.

In a world that is getting softer by the minute, I think we could use an extra dose in our lives.

The Haters

In that post, there were two main criticisms to Jack’s way of running GE.

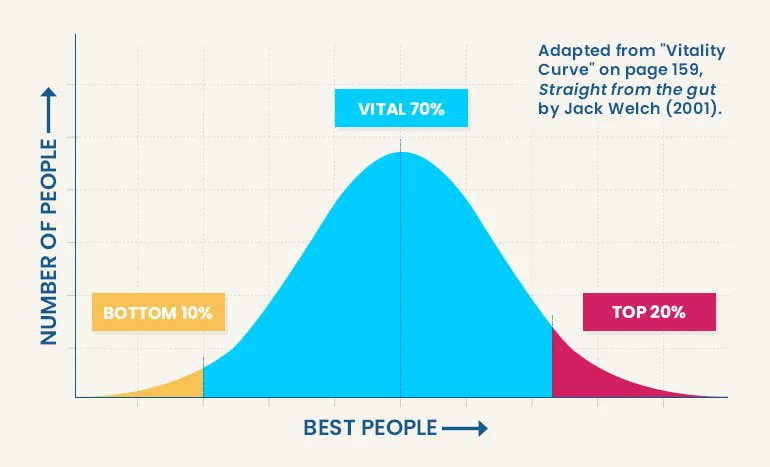

The first one was the infamous “Rank and Yank” policy.

It’s basically getting rid of the bottom 10% of the organization. The ones who don’t perform. The “rest and vest”. The complainers.

Jack’s argument was that these people would be happier somewhere else.

There’s a lot of hate on this policy as evidenced in the comments. But was it, really?

If you’ve ever worked in a corporation, you might have noticed that there is always a performance management system. A process that intends to rank and stack employees based on accomplishments, effort, attitude, and other factors. What you do and how you do it.

There are standard metrics that are used by managers to let you know where you stand in the organization. Some examples are: exceed expectations, meets expectations, needs improvement. And based on where you land, you might or might not get that promotion you’ve been so patiently waiting for.

This is exactly the same thing as GE’s old policy. The difference is that these companies might keep those people, which is a detriment for both, the individual and the company. The employee is unhappy and the company is losing money because of a headcount that is not producing a return.

The second criticism was that he manipulated earnings.

A little bit of context …

During that time, GE was a conglomerate. It had many businesses.

Healthcare. Aviation. Energy. Even a financial services business. GE Capital.

When the time came to report earnings to Wall Street, GE never broke down the performance of each individual business. It was all lumped up.

Why is this an important detail?

GE Capital was a cash machine. As profitable as they get. There’s rumors that even investment bankers wanted to work there. Why? Lack of regulation. In other words, deal making was freakin’ cool.

Because it was so profitable, whenever an industrial business struggled, GE Capital would always cover the losses. This created a very smooth quarterly performance for the company. Wall Street got accustomed to earnings calls filled with good news and no bad surprises.

Was this manipulating earnings? It’s a fine line, but I don’t think so. Executives all over the world know that “keeping a penny in your pocket” is a good strategy to fall back on. And GE didn’t make trades like Enron or WorldCom.

Genius or fraud?

As with any public figure, Jack will always be subject to scrutiny.

He wasn’t perfect. But he wasn’t a total failure either. Just like everything else, it’s never black and white. The answer lies somewhere in the shades of grey.

This man took a company from domestic player to international powerhouse, created one of the most coveted leadership development institutes (Crotonville), and sent out many executives to run the biggest companies in the world after their time in GE.

For me, personally, he falls more under the category of genius.

What do you think? Let me know in the comments.

Until next time,

Antonio.

P.S. Below is the link to the post if you want to read it (the comments are the best part).

Not been too familiar with him, really appreciate your insights here

Jack Welch’s biggest failure after the BIG BIG ! mistake of his own designed GE Capital very short-term funding strategy... was the selection of his successor.