The Buying vs. Renting Dilemma

How Interest Rates Affect Homeownership

If you’re thinking about buying a house, this might change your mind.

Before you make a big financial decision, you need to make sure you weigh all the pros and cons.

And one of the biggest financial decisions you’ll ever face - after leaving your parents house - is whether you should buy or rent the place you’ll call home.

There are many factors that will influence this decision.

Financial factors such as: how much income you make per month, the interest rate offered by the bank, or how much cash you have for a down payment.

Non-financial factors such as: will you stay in that city for the next 10 years, are you single or do you have a family, or do you want the house as a home vs. a rental property.

Considering that most likely you’ll spend the next 20-30 years paying that house, it’s a good idea to arm yourself with as much knowledge as you can get before signing a mortgage.

So, where do you start?

First, let’s go back in time.

The American Dream

It’s 1945. The end of World War II.

Soldiers were returning from war, the economy was booming, and the middle class was expanding rapidly.

The federal government offered subsidized loans to help returning soldiers buy homes. This initiative institutionalized the concept that homeownership was the epitome of American success.

The US government wanted to create stable communities and stimulate economic growth through the housing market and construction industry.

Suburbs started to grow. And with them, shopping centers, schools, and hospitals, started to grow like mushrooms, further boosting the economy.

As time went by, the media contributed to this notion too. Movies and advertisements often portrayed happy, successful families living in their suburban homes with a white picket fence. A true dream come true.

Over time, this image solidified into a cultural expectation.

The ownership of a home came to symbolize freedom, success, and the attainment of the American Dream.

Time To Wake Up

That dream is a lot harder to attain now than before.

Why? You ask. Well … where do I start?

The purchasing power of the dollar has weakened. Fact.

Many reasons have contributed to this. But one important factor is the increase of interest rates. That matters because a 1% increase in a mortgage rate can impact the type of house you can buy.

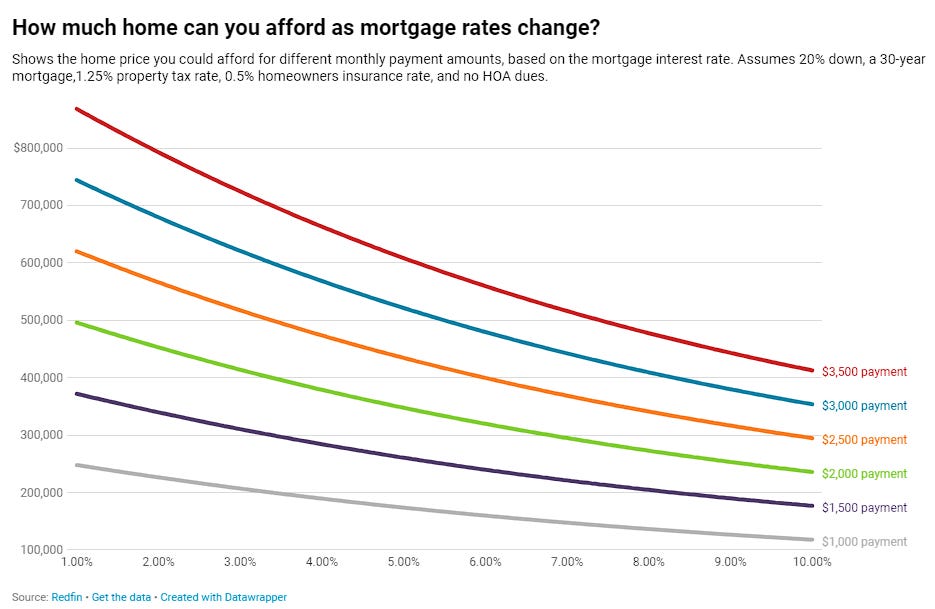

Take a look at the chart below:

A $3,500 monthly payment can get you a house from $400,000 (when the rate is 10%) to a house worth $800,000 (when the rate is 1%).

Crazy, right? And that’s not all.

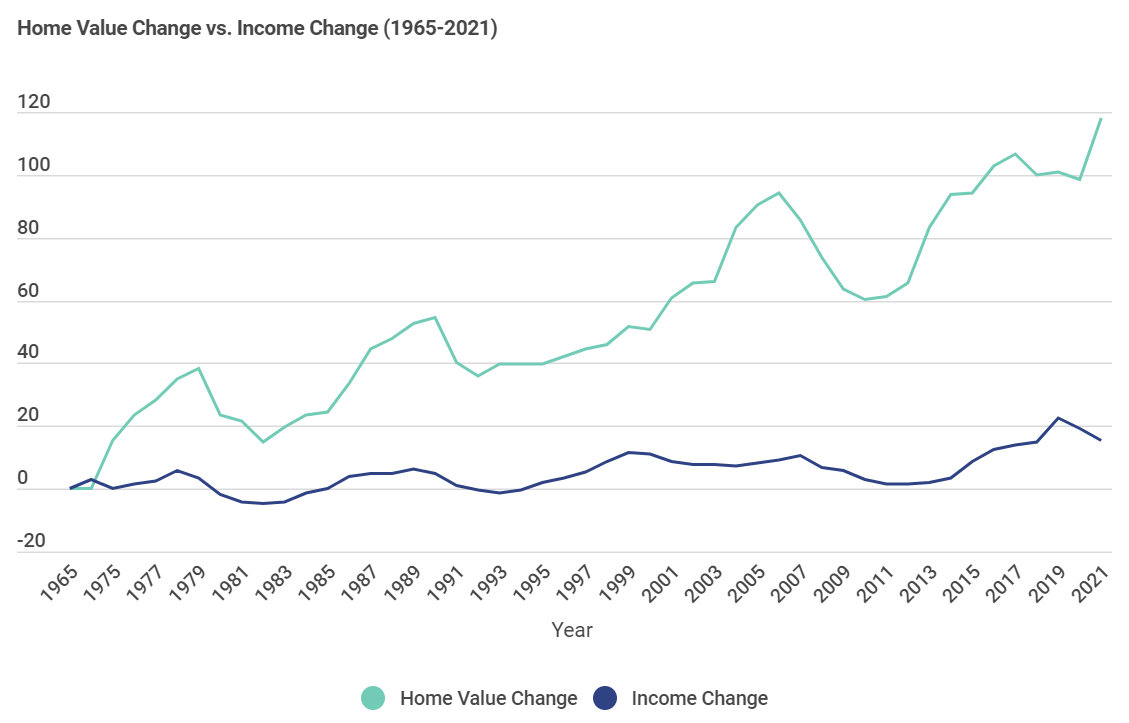

Home prices have significantly gone up (118%) relative to median household income (15%), after adjusting for inflation.

And the cherry on top is that the gap between skills and high paying jobs keeps getting wider and wider by the day.

It certainly does feel like the deck is stacked more and more against you.

It feels like the only people able to buy a family home nowadays are the consultants, bankers, and engineers. And not the entry-level ones. Nope. The senior-level ones.

Ask anyone living in the Bay Area.

It’s not for the soldiers anymore. It’s for the elite.

But I digress …

Let’s assume you actually fall into the privileged category of someone who has the option to buy.

You have a decent paying job, and some cash saved in the bank.

Should you go ahead and buy a house?

Math Never Lies

My short answer is NO. At least not right now.

Let me illustrate with an example.

Let’s say you want to buy a house that’s listed at one million dollars.

You have 20% of that in cash to make a down payment (this is probably the optimal ratio to buy a house, as many financial experts will tell you).

That means you need a bank loan for $800,000.

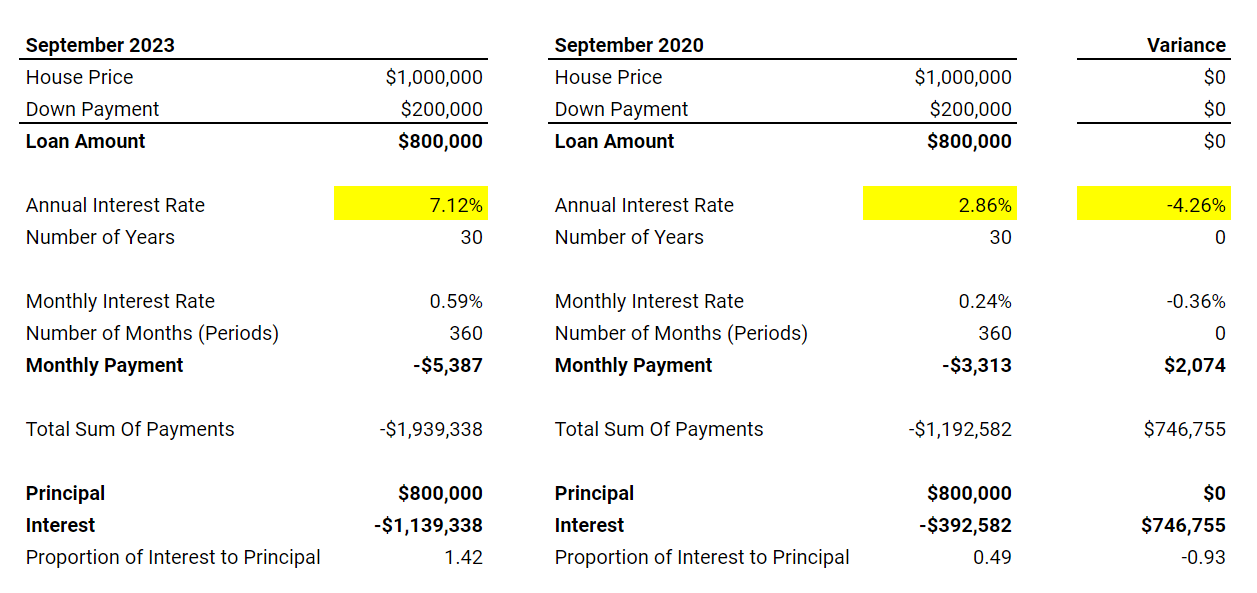

On average, banks are offering a 7.12% rate on a 30-year mortgage. Remember, this is stated on an annual basis. Therefore, you need to divide the rate by 12 and multiply the years by 12 to get a monthly view. After all, you’re making monthly payments.

With that information and some basic time value of money knowledge, you compute the monthly payments, which equals $5,387.

Now, this is where it gets interesting …

When you add up all the monthly payments, you get $1,939,338 (total cost of the loan).

What that means is that you paid back $800,000 of the loan in full (also known as the principal and your equity) AND you paid the bank $1,139,338 in interest.

In other words, for every $1 dollar you paid for the $800,000 loan, you paid another $1.42 of interest ON TOP.

Talk about making the bank rich.

If you’re not shocked by now, let’s compare that scenario with what you would have paid if this was 2020.

Three years ago, the average interest rate on a 30-year mortgage was 2.86%, which is 4.26% less than right now.

I’ll spare you all the math we did before. But two things stand out here:

The monthly payment would have been $2,074 less than today; and

You would have paid $392,582 in interest. Or $0.49 of interest for every dollar of principal paid.

Those numbers are significantly lower than the amount of cash you would have to disburse if you were to buy a house right now.

The cost of doing X is not doing Y.

One of the most important financial concepts is opportunity cost.

Opportunity Cost = Chances You Miss By Not Doing (Or Doing) Something

The cost of eating cake every day is to not have a six pack.

The cost of binging on Netflix is not reading a book.

The cost of buying a house is not investing in something else that might have a better return.

Think about it this way. What other things could you have done with that $1.1M dollars you paid the bank as interest?

You could have invested it in the stock market, which tends to perform better than real estate.

You could have started your own business (probably a few of them with that amount of capital).

You could have put it in a trust fund for your kids.

The options are many.

The key thing to understand here is which investment makes the most sense for you.

And by now, you should see that a house is, probably, not the best one.

At least not right now. I’ll keep saying this.

Banks won’t help you make that decision. It’s not in their best “interest” (funny word to use).

This is why understanding the basics of personal finance is important. You should be able to make a quick spreadsheet like the one I have above to make an educated decision.

This is the first step. There’s many others like estimating the phantom costs such as property taxes, repairs, maintenance, etc. In a span of 30 years, that will add up.

With that said … let me write the biggest disclosure of all.

Buying a home is something VERY personal. And even if it doesn’t make financial sense, it might make sense in some other way to you (e.g. building a home for your kids to grow up).

I just hope if decide to buy a house, you do it being aware of the financial implications of it all.

If you have any questions on this, please let me know. I’d be happy to help you or point you in the right direction.

Hope this helps you with one of the biggest decisions in your life.

Wish you a fantastic Sunday and an amazing start of the week.

Until next time,

Antonio.