Why Layoffs Are Far From Over

The REAL reasons why companies are firing their employees.

Welcome to Money & Robots, a weekly newsletter where I provide insights on finance and technology to help you become more business savvy.

Imagine this …

You wake up, get a cup of coffee, get dressed to start your day. The usual routine you go through right before you go to work.

You decide to check your email to make sure there’s nothing urgent before you start the day. And then, suddenly, you can’t access your emails. You get a cryptic message saying your company has decided to block your account.

You panic.

You check Twitter and LinkedIn and there’s a bunch of people posting they’ve been laid off from the same company you work for.

You open the Wall Street Journal and see right there on the front page in bold letters: There were massive layoffs in your company.

You text your manager, and when he finally replies, you find out you were let go overnight. Ouch.

This happened to thousands of employees in FAANG and other companies around the world.

But why? Aren’t these companies supposed to be the most profitable in the world?

You’d think they have enough cash to keep their employees, right? Well, it’s more complicated than that. Let’s break it down.

There are four main reasons why all these companies are firing their employees. Let’s go through each of them.

Post-Covid Reality

If you go back to the start of the decade, the world entered a period of confinement as a public health safety measure.

People couldn’t go to their offices to work or go to the grocery store to buy food. The world lost, for a little while, the freedom to work productively and consume freely.

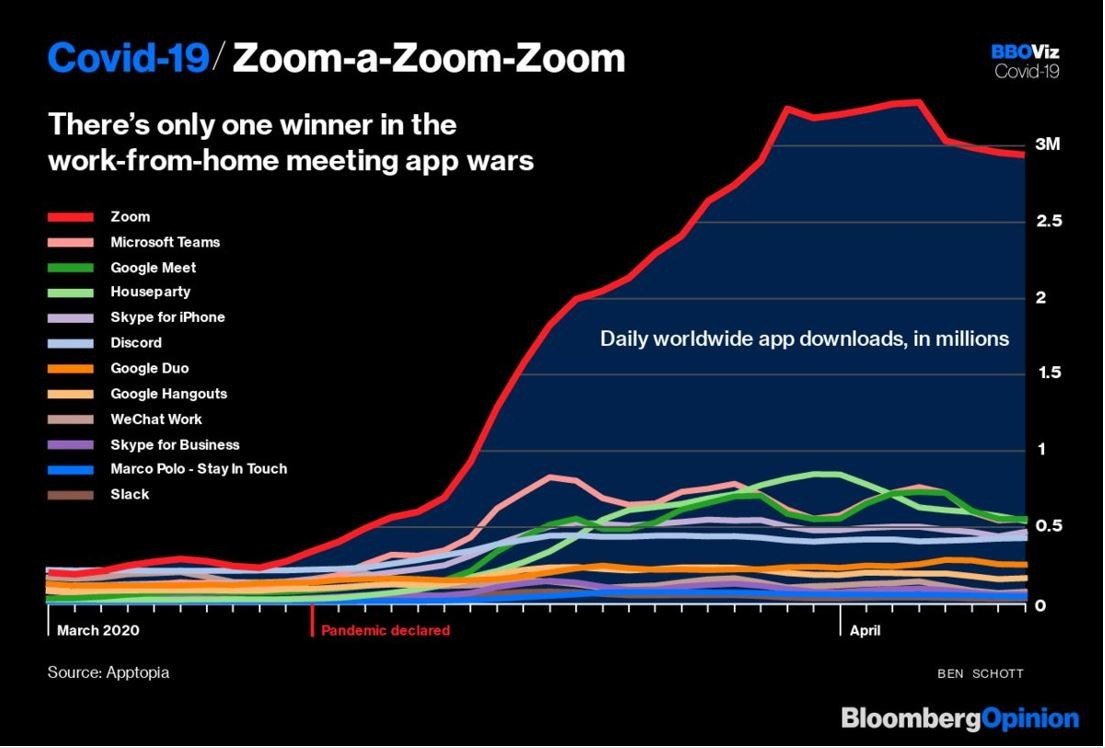

But then, the tech companies came to save the day. Microsoft, Amazon, Google, Netflix, Zoom, Slack. They gave governments and businesses the ability to operate as if nothing had happened by using their products.

Whether it was video-conferencing software, office productivity tools, or management of their tech stack via the cloud, the world started to shift into a path of digital transformation.

Business plans and financial forecasts were updated to reflect the new reality. One where the world was finally accelerating its reliance on tech giants. And more importantly, it was a complete paradigm shift rather than an anomaly.

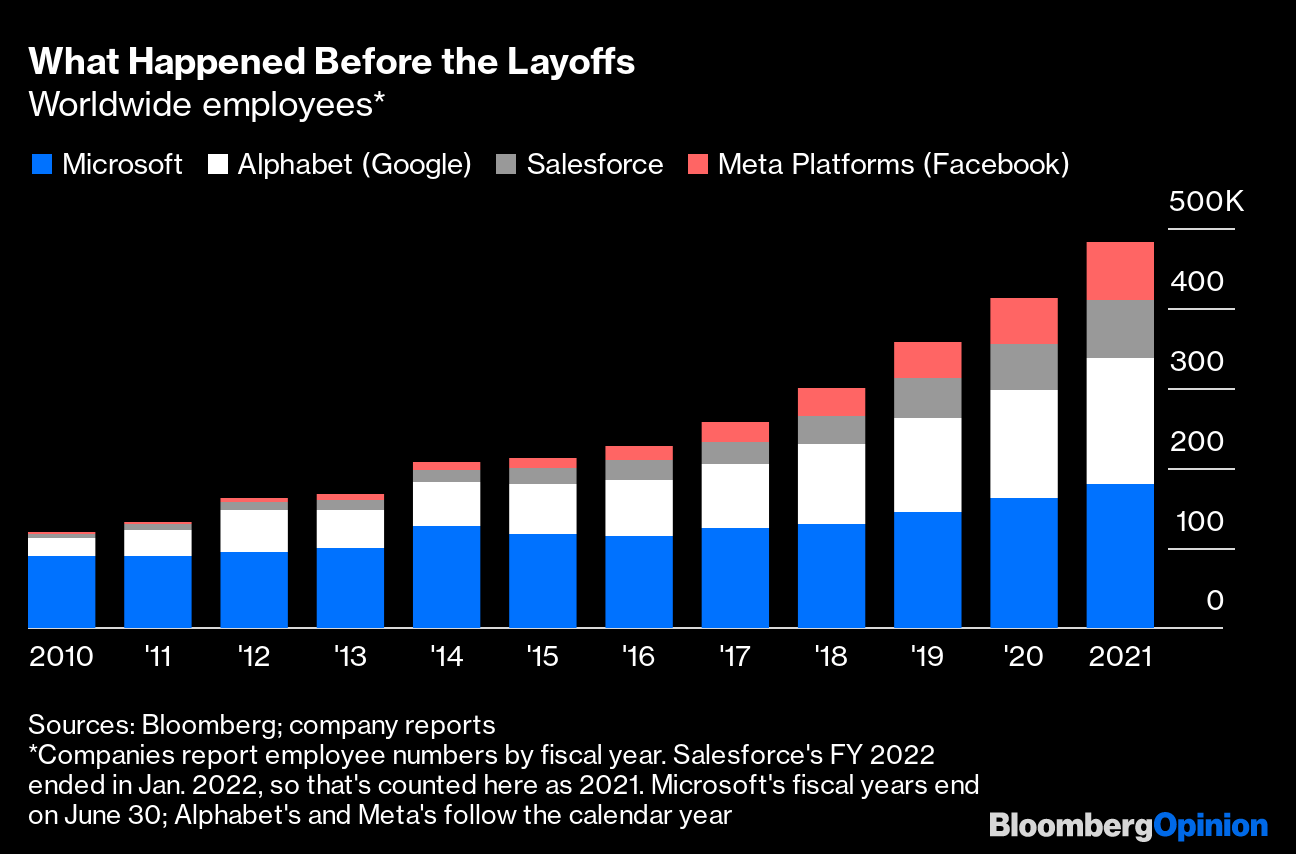

Companies assumed a big amount of revenue was expected to come from this shift. Which meant companies had to invest more aggressively in hiring talent to develop the products of tomorrow.

Take a look at these chart. You can see the headcount growth during the years we had Covid. Because the growth expectations were so strong, hiring this many people made sense.

But, what if this was, in fact, an anomaly?

What if, after Covid, people wanted (or were forced to) go back to the office?

What if people preferred buying their groceries in person rather than through an app?

What if businesses wanted to invest money in other things rather than digitizing all their tools and processes?

Then all these companies would be stuck with a massive cost structure while revenue started to decline.

This translates into lower profits on a long-term basis, which is not well-liked by investors. To keep investors happy, profits have to be grown over time.

And the only way to rectify a mistake like this one, and quickly, is to fire employees.

Immediate cost cutting.

And as we’ve seen lately in earnings reports, Wall Street liked it.

The Stock Price

A company’s stock price reflects the collective opinion and sentiment of market participants regarding the company's future prospects.

Positive news, such as strong financial performance can drive the stock price up, indicating optimism about the company's future.

Conversely, negative news, such as poor earnings can lead to a decline in the stock price, reflecting concerns or pessimism about management’s ability to run the company.

There are two things that are important here:

1. Executive compensation is tied to how well the stock performs in the short term and the long term. So, there’s an incentive for executives to keep the stock price as high as they possibly can. The higher it is, the richer they get. This also applies to investors, though. Regardless if it is an individual or an institution that buys a bunch of stock, their expectation is that the price will go up and they’ll get a return.

2. Tech companies tend to have highly bloated cost structures. Example … Twitter. When Elon Musk took over the company and made it private, he cut payroll cost by firing 80% of the staff he considered non-essential. A lot of roles like recruiting, program management, operations, strategy, etc. are roles that don’t contribute to designing, developing, marketing, or selling the product. Therefore, they’re typically the ones that get cut first.

If you look at the market’s reaction after the layoffs, you will notice that the price went up in most FAANG stocks. Check the upward trend after November 2022.

Why?

Because to the market, these cuts mean the companies are course correcting. Which is a good thing (for management and investors; not so much for employees).

But what if it the cost cuts are not enough?

Recession

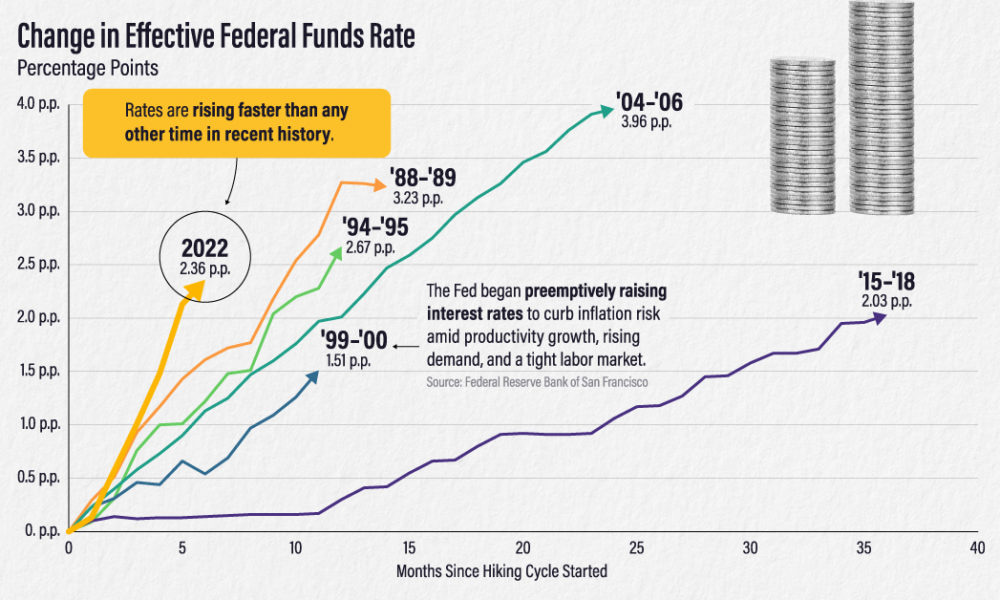

Even though we’re not in a recession yet, we are living in a highly inflationary environment. Interest rates are rising and the prospects of a collapsing economy get more dire by the day. And a weak economic environment means that businesses won’t grow. In fact, they might shrink.

A weak economy has a domino effect. If a consumer doesn’t shop as much online, it’s not just the business that runs the online store that gets affected, but also the payment platforms like Shopify or Stripe, because the volume of transactions decreases.

Because of this lower economic activity, businesses in this type of environment typically tend to be more conservative and cut spending as much as possible, anticipating the fact they’re no longer in growth mode, but survival mode instead.

This is where layoffs start to happen. Jobs that are open to help the company grow are the first ones to go. Support functions like recruiting, strategy and operations, marketing, and even finance. This is backed up by a study done by Revelio Labs.

As long as the economy continues to weaken, layoffs are likely to continue.

The AI Wars

Artificial intelligence will have a massive impact on jobs. No question about it.

Think about ChatGPT, Bard, and all the applications that are being created right now using their APIs. Even Apple is rumored to come up with their own GPT. All of this has the intent of making people and businesses more productive and save some cost.

Let’s take the example of copywriting. Pre-AI, you’d hire a freelancer or an agency to work on your copy to sell a product. There would be meetings where people would go over multiple revisions until a decision to choose the winner was made. Now, you can ask ChatGPT to create compelling copy in a similar style to David Ogilvy by only spending 20 dollars a month. And without the hassle of multiple meetings or dealing with an agency or freelancer.

Another example is the amount of hours people spend making presentations or data analysis. I’ve been there myself. And it sucks. But that may be fixed soon enough.

Microsoft launched Co-pilot recently and it is supposed to help you do just that. Reduce the amount of time finding inspiration to create a presentation, think about the messaging, the tone, and soon enough, it will perform complex analytical tasks.

This will reduce the amount of hours spent in these activities. And in business, 8 hours a day, 5 days a week, for a full year is equivalent to hundreds of thousands of dollars saved in payroll. You can bet there’s a few full time employees who perform this type of work that will get cut. Unfortunately, this is unavoidable.

Business is evolving at a rapid pace. And all of this will create new ways of looking at profitability, efficiency, and productivity. Layoffs are just a symptom of what’s coming in the next few years. And we should be prepared to reinvent ourselves to catch the new wave.

If you enjoyed this week’s newsletter, please share it with your friends and family!

See you next week!

Antonio.